Meet Sarah.

She just abandoned her third shopping cart this week because she couldn't find answers to her questions about shipping and product sizing.

She's not alone. With new ecommerce brands launching every hour, customers have endless options and zero patience.

The brands winning Sarah's business aren't necessarily offering the lowest prices or fastest shipping. They're winning through what is both simpler and harder to execute: ecommerce customer service that makes people feel valued and a seamless shopping experience.

What is ecommerce customer service?

Ecommerce customer service is the support you provide to your customers before, during, and after they make a purchase from your online store. It includes everything from answering pre-sale questions to resolving issues with delivery, product quality, warranties, returns, and exchanges.

Whether helping a customer choose the right size or replacing a damaged item, great ecommerce customer service turns casual shoppers into loyal customers — and loyal customers into brand advocates.

Why ecommerce customer service matters now more than ever

You might wonder: If my product is great and I invest heavily in marketing, isn’t that enough?

Not quite. Without reliable customer service, all those marketing dollars are likely to go to waste. As soon as word spreads that your brand is hard to reach or unhelpful when problems arise, trust evaporates — and so does your customer base.

On the flip side, when you do invest in great customer service as an ecommerce brand, the rewards speak for themselves: more loyalty, higher conversions, glowing reviews, and sustainable growth.

Let’s break down why it matters.

Higher conversion rates

Conversion rates are a pain point for most ecommerce businesses, with the average hovering just above 5%. But excellent ecommerce customer service can give this number a lift:

Proactively surfacing helpful information — like tips on how to take measurements for the right fit — using tools like Help Scout’s Messages can go a long way in boosting conversions.

When potential buyers have questions about shipping times, return policies, or product details and get quick, helpful answers, they are far more likely to click that “Buy Now” button.

On top of that, great service leads to glowing reviews about your company online. Since 98% of shoppers check reviews before purchasing, those positive experiences can directly influence new conversions.

Brand loyalty and repeat business

According to PwC, customer experience matters more than traditional advertising for most U.S. consumers. That means your customer support team can have a bigger impact on purchasing behavior than your flashiest ad campaign.

When shoppers feel valued and supported, they are more likely to come back again and again. Over time, these repeat customers will have a significant impact on your revenue, and they often become vocal fans of your brand, spreading the word organically.

Positive word of mouth and referrals

There’s nothing more powerful than a happy customer telling their friends about your product.

We live in a world where trust in institutions — including businesses — feels like it’s in free-fall. Exceptional customer service creates unexpected “wow” moments that people want to share, whether that happens online or in face-to-face interactions.

Common customer service challenges for ecommerce teams

While the daily ticket queue of ecommerce support can throw anything your way, there are a few big challenges that just about every support team faces time and time again.

Here are the main ones I’ve seen across all of the ecommerce customer service teams I’ve helped start and scale over the last decade.

Seasonal volume spikes

Between Black Friday, Cyber Monday, and the countdown to Christmas, ticket volumes can skyrocket overnight.

Every team handles this differently. Some bring on seasonal contractors or outsource to support partners. Others adjust customer expectations by extending response times and being super transparent with customers.

There’s also the option of building a slightly overstaffed in-house team that can shift between customer support and non-urgent work (like writing product descriptions or updating help center articles) during the slower months.

However you tackle it, one thing is clear: holiday prep starts months in advance. And with shopping events popping up all year long (Valentine’s Day, Mother’s Day, Christmas in July, Prime Day, you name it), the calendar is starting to feel like one long warmup for peak season.

Product issues outside of your team’s control

Few things are more frustrating for an ecommerce support agent than trying to deliver a five-star experience when the product just isn’t holding up. Defects, quality issues, or inventory inconsistencies are often outside the support team’s control, but they have a direct impact on the customer experience.

What can you do?

Start by keeping a clear log of recurring product issues and regularly analyzing trends. If you’re dropshipping or selling third-party products, this kind of insight is gold — it can help your team advocate for better suppliers or even recommend switching to a more reliable production partner or white-label option.

At the end of the day, no amount of excellent support can make up for a poor-quality product. Fixing quality issues at the source is crucial for long-term success.

High return rates

Offering free returns is great for conversion, but some customers treat online shopping like a “buy now, decide later” game, especially in categories like apparel or home decor. When returns pile up, it creates a major workload for support teams and a hit to profitability.

Instead of tightening your return policy and risking a lower conversion rate, you can take a more strategic approach:

Identify your ideal customer profiles with the lowest return rates, and work with marketing to attract more of them.

Collect return reasons to understand why customers are sending items back, and work with your website development and product teams to address those issues proactively.

Optimize your product experience. For fashion brands, this could mean providing super detailed garment measurements or showcasing clothes on different body types. For other products, clear photos, videos, and honest descriptions go a long way in reducing “not what I expected” returns.

How to build a winning ecommerce customer service strategy

So, where do you start with building a customer service strategy that delivers great customer experiences and prepares your team to handle the challenges above?

It all starts with structure. Here’s how to lay the foundation for support that scales.

Start by documenting your SOPs

One of the best things you can do for your team (and your customers!) is to write down your standard operating procedures (SOPs). Start by answering these key questions:

What voice and tone should your brand use? This sets the stage for your help center content, macros, chatbot language, and even who you hire. Are you aiming for friendly and fun or professional and polished?

How flexible is your team with discounts or custom requests? Will you follow strict decision trees with AI and automation handling most inquiries? Or are you aiming for high-touch, personalized service with custom replies for each case (often the approach for luxury goods)? The right answer depends on your business model as well as support volume and resources.

What are your return, replacement, and exchange policies? Can orders be edited and, if so, for how long? What’s the step-by-step process for handling these requests?

As you write things down, you’ll likely uncover gaps, especially in customer-facing content. Anything that customers might want to know should live in your help center, not just your internal docs. You can use apps like Notion for internal processes and tools like Help Scout’s Docs for public help resources.

Define your response time goal and coverage needs

Ecommerce customers expect speed, and immediate replies matter to most of them (90%, according to HubSpot's research). Think about the markets and time zones you serve — what coverage do you need to meet expectations?

As a general rule:

Email responses should land within a few hours (and max out at 24 hours).

Replies via social media channels are expected within a couple of hours, if not sooner.

Live chat responses should come within minutes, or you’ll start seeing complaints.

To make this work without overhiring and hurting your bottom line, lean into AI automation and self-service tools. A smart chatbot and a well-structured help center can deflect a ton of ecommerce customer service inquiries, keeping your human team focused and response times snappy.

Set up systems for collecting insights

If you're a team of one or just getting started, it’s tempting to focus only on replying to tickets. But without tracking and reporting on trends, it’s hard to scale, improve things, and make an impact over time.

Start small:

Tag conversations by topic, issue, or sentiment (AI tools can help automate this).

Log return and replacement reasons by product.

Use that data to identify product quality issues, common support topics, and operational gaps.

Something as simple as a Google Sheet can do the job if you're not using a voice of the customer (VoC) platform or haven’t yet automated returns with a tool that includes built-in analytics. The goal is to spot patterns to be able to make informed decisions as your business grows.

Choose the right KPIs for your ecommerce customer service team

No strategy is complete without a way to measure success. Plenty of common customer service metrics make sense to track when you’re leading an ecommerce support team, including:

CSAT (customer satisfaction score): How happy are customers with the support they receive?

CES (customer effort score): How easy is it for customers to get help?

First reply time: How fast does your team respond?

Resolution time: How long does it take to fully resolve an issue?

Tickets per order rate: How effectively are you surfacing policies and product information to customers, helping reduce unnecessary interactions?

Don’t overwhelm your team with a million metrics. Pick the ones that matter most, track them consistently, and use that data to drive improvements over time.

Ecommerce customer service best practices

Now that you’ve got your SOPs in place, your KPIs defined, and systems set up to track insights, it’s time to take your customer service to the next level.

The best practices below will help you deliver a top-notch ecommerce customer service experience.

Invest in customer-facing FAQs

Many customers try to resolve issues themselves before reaching out for support, so give them the tools to succeed. Make sure your FAQs and help center cover the most common ecommerce questions, and surface this info in all the right places:

On product pages.

In your website’s dedicated FAQ or Help section.

In order, confirmation, and shipping emails.

Must-have topics include:

Product details, materials, sizing, and care instructions.

Shipping timelines and regions.

Return, refund, and warranty policies.

How to cancel or edit an order.

Take it a step further by regularly analyzing incoming support requests and updating your FAQs based on common themes. The more helpful your self-service resources are, the lighter the load on your support team.

Leverage AI to scale support

Ecommerce is one of the few industries where AI can already handle a significant portion of customer requests automatically, so if you’re not taking advantage of this, you’re missing out.

Once your help center is built out, you’re ready to roll out an AI-powered chatbot to handle common questions, share order updates, and provide after-hours support when your team is offline.

Tools like Help Scout’s AI Answers make this easy, as long as your knowledge base is optimized for AI:

Keep each article focused on a single topic.

Clearly state the question being answered in the title or the first paragraph.

Use consistent terminology that matches how your customers speak.

Beyond bots, AI can also help draft responses for tickets that reach your support agents. For more complex, lengthy conversations, tools like Help Scout’s AI Summarize feature offer major efficiency gains by quickly highlighting key details.

Provide multi-language support

Seventy percent of customers prefer doing business with companies that offer support in their native language. That’s a huge opportunity to build trust and boost retention.

If your ticket volume and budget allow, you can hire native-speaking agents or bilingual team members, especially in markets like South America (for Spanish/English language) or Europe, where multilingualism is common.

For smaller brands, full multi-language coverage might not be feasible — but AI has your back here, too. Many help desks, including Help Scout, now include AI-powered translations that are nearly indistinguishable from human responses and can be a cost-effective way to support international customers without hiring an army of agents.

Monitor and learn from customer reviews

Today’s customers want to be heard, and they want to hear from other customers, too. Customer reviews are a powerful source of insights for improving the overall customer experience, and they’re also a major factor in influencing purchase decisions.

Tools like Yotpo or Stamped make it easy to collect and showcase reviews, and more importantly, they give your team visibility into the full customer journey, allowing you to sort, filter, and save precious customer feedback. Analyze it to identify common themes, and use those insights to improve the customer experience or advocate for changes across other areas of the business.

For example, delivery issues are a common challenge in ecommerce. By analyzing reviews, you can tag which carriers are most frequently associated with complaints and evaluate whether it’s still cost-effective to rely on them or if switching to a more reliable provider makes more sense.

Knowledge is power, and tapping into customer feedback helps you make smarter, more customer-centric decisions.

Offer omnichannel support

Some customers still want to pick up the phone. Others expect instant answers via live chat. Many are more than happy to slide into your DMs or send a quick email. In 2025, offering support on just one or two channels simply isn’t enough — you need to meet customers wherever they are.

Thankfully, modern ecommerce customer service software makes omnichannel support easier than ever.

The 10 best ecommerce customer service software

Here’s a list of the 10 best ecommerce customer service tools to consider if you want to deliver an exceptional customer experience.

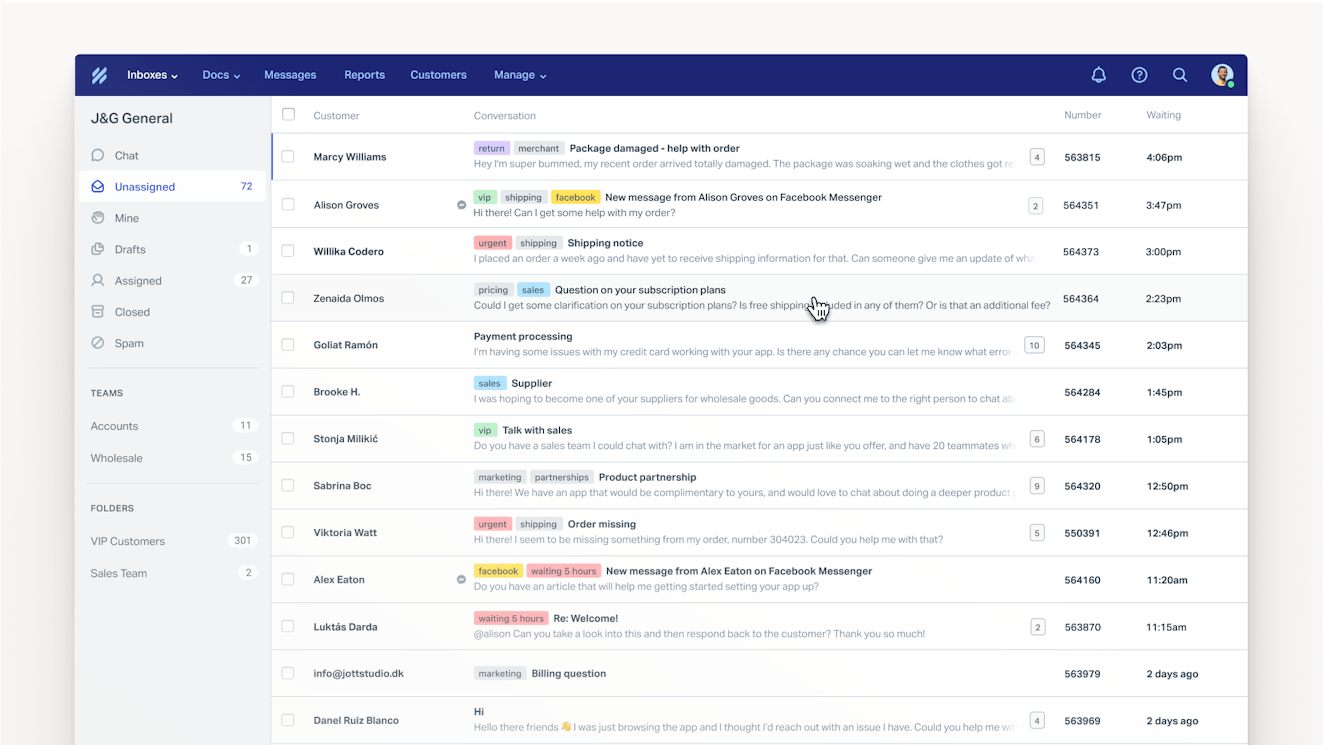

1. Help Scout – Best for omnichannel customer support

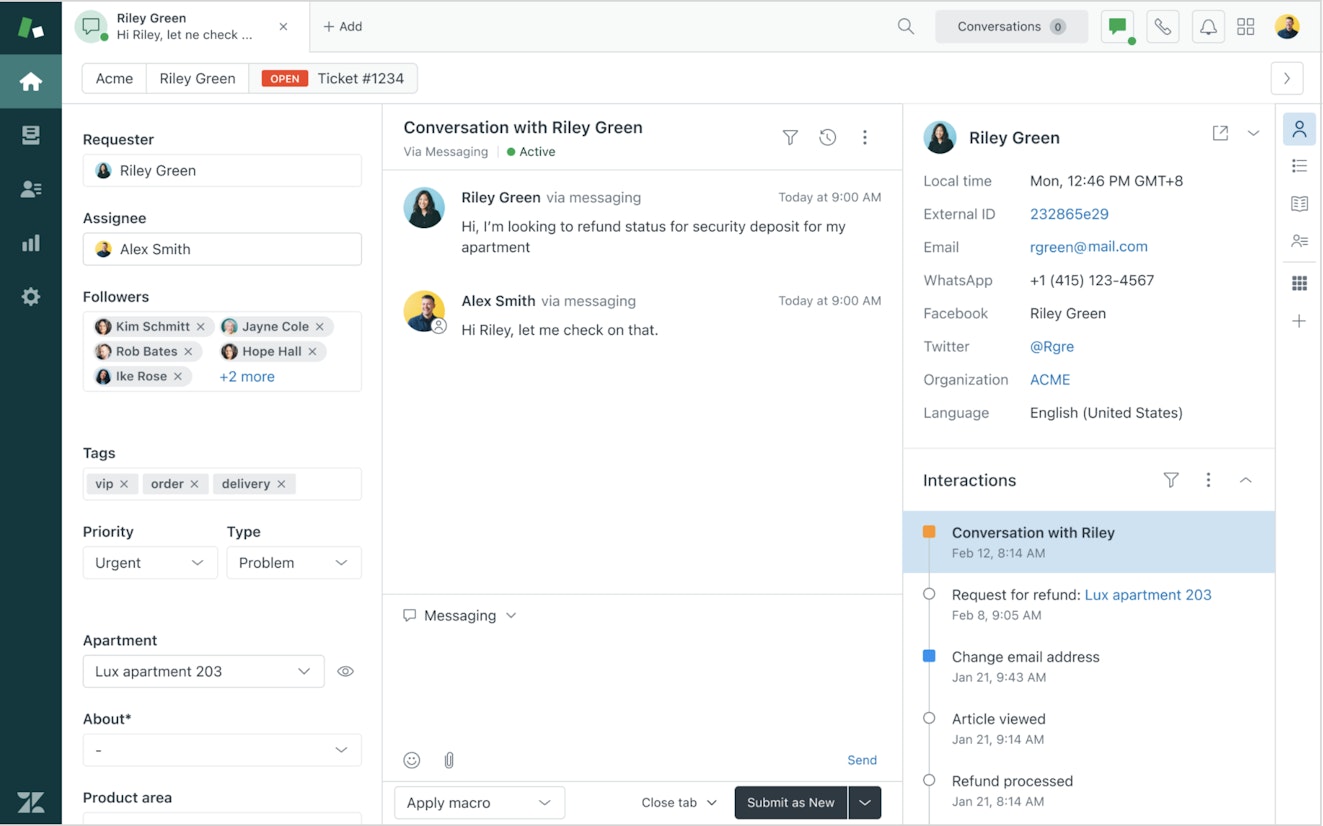

Help Scout is a help desk that allows ecommerce businesses to manage customer conversations across popular channels like email, live chat, and social media all in one place. Here’s how it can optimize your customer support operations and why it’s a go-to choice for many ecommerce companies.

Support channels

Help Scout integrates directly with the channels and tools your customers already use:

Email: You can connect multiple mailboxes and handle tickets for each separately, which is especially helpful if, for example, you manage bulk order inquiries and B2C orders separately.

Messaging: Help Scout offers Beacon, the platform’s live chat widget. Beacon is easy to install and included in every plan — use it to support customers in real time, surface your knowledge base content and send AI-generated answers, advertise sales, or survey customers with proactive messages while they browse your site.

Social media: Beyond email and live chat, Help Scout integrates with Facebook Messenger and Instagram DMs — key customer touchpoints for many ecommerce brands today.

Shared inbox

All messages from connected channels flow into a shared inbox, where you can group them into folders, assign them to agents, tag them, and leave internal notes while viewing customer details directly on the conversation page. You can also set up saved replies for common customer queries to save time and ensure consistent communication.

Internal notes are particularly handy for asking quick questions or escalating tickets to other teams. For example, if a customer has a specific question about shipping, you can escalate the ticket directly to the fulfillment team to answer.

Unlike some tools that charge per seat, Help Scout allows unlimited users, so everyone in your business can join the system and collaborate.

Ecommerce integrations

Switching between apps can be a pain, especially for ecommerce teams that need order and inventory information to resolve most tickets. Help Scout simplifies this by integrating with popular ecommerce platforms:

Shopify: You can view customer and order details (like order history, fulfillment status, and tracking numbers) directly on the conversation side as well as process refunds, duplicate or edit orders, and review order history without ever leaving Help Scout. What a game changer!

WooCommerce and Magento: Access customer and order details from the conversation sidebar by installing widgets. (Note: WooCommerce charges $8.25 for its plugin.)

Automation and AI

Most support teams are looking to eliminate as many manual tasks as possible. Help Scout makes this easy.

With workflows, you can automate repetitive tasks like assigning, tagging, or escalating conversations. For example, if you have a specific team in charge of issuing refunds, you can have emails with the term “refund” in their subject lines automatically assigned to that team. Additionally, all Help Scout plans include AI tools designed to boost agent performance and streamline support operations, including:

Summarize: Create concise summaries of long conversations, making it easier for teammates to understand the context when escalating tickets without reading the entire back-and-forth about a lost delivery or a product issue.

Assist: Need to double-check grammar, translate a message, or adjust the tone of your draft? Help Scout’s AI can do it all with just one click. If you’re working with an international customer base, you can offer support in the customer’s language even if your agents only speak English. The grammar checking feature helps agents create drafts faster, reducing response and resolution times.

Drafts: Leverage the power of GPT-4 to generate high-quality draft responses based on prior conversations and your help center articles, enabling agents to craft quality replies in seconds. Help Scout’s Drafts is especially effective for ecommerce, where many inquiries are repetitive and most teams are dealing with the same shipping details, tracking info, and product FAQ inquiries.

Answers: With Answers, you can provide instant responses to common questions through your chat widget, Beacon. Answers pulls information directly from your knowledge base, so having a well-organized Help Center is crucial. If you cater to a global audience across multiple time zones but don’t have resources for 24/7 support, Answers ensures your customers get the help they need — even while you sleep.

Help center

With Help Scout Docs, you can create a customized help center, making it easy to publish FAQs, promote self-service, and ensure customers can quickly find the information they need.

You can create public help center articles for customers as well as private collections for internal use only. What’s important is that all of your external-facing articles are optimized for search both within your help center and on Google so customers can easily find what they’re looking for.

Reports

Finally, Help Scout’s reports enable you to dive deep into your customer support metrics, tracking conversation volume, response and resolution times, and agent performance metrics as well as trending issues and your help center stats.

You can also create custom dashboards, apply filters, and segment data based on conversation tags or custom attributes to get a tailored view of your team’s performance and key support trends.

Pricing

All of Help Scout's plans include unlimited users and unlimited AI usage. A free plan is available that includes email, chat, social, and self-service support for up to 100 contacts*/month. Paid plans start at $25 per month and include additional features like advanced reports, customer properties, and CSAT surveys.

*A contact is someone who received a reply from your team or had their question resolved by AI Answers in a given month. Multiple conversations with the same person count as one contact.

2. Gorgias – Best for customer sentiment and intent detection

What sets Gorgias apart is its laser focus on ecommerce. Rather than offering a one-size-fits-all solution, Gorgias has been designed to address the specific challenges faced by ecommerce support teams.

Key features

AI-powered sentiment and intent detection: Leveraging AI trained specifically on ecommerce tickets, Gorgias can classify sentiment (e.g., positive, negative, urgent) and detect common customer intents such as refund requests, order cancellations, and product inquiries. This allows you to trigger automations based on identified sentiment or intent — for example, to auto-tag Instagram comments based on sentiment.

Ecommerce integrations: Gorgias offers two-way integrations with popular ecommerce platforms like Shopify, BigCommerce, and WooCommerce. It pulls customer and order information directly into the platform and allows you to add details like order numbers and tracking links into macros to solve common inquiries like tracking requests with a single click.

Automations within macros: Gorgias offers robust automation options for macros that don’t require a developer or a consultant to configure. For instance, you can edit shipping addresses, apply discounts, issue refunds, or cancel orders by simply sending a macro that executes an automated action for you via API.

Revenue impact report: Measuring customer support’s return on investment can be tricky, and Gorgias makes it easier with revenue statistics. It tracks converted tickets that lead to a sale within five days, allowing you to measure your support team’s direct impact on sales and conversions and prove support ROI to other stakeholders.

Who is Gorgias best suited for?

Gorgias is a great choice for ecommerce businesses that want to leverage AI to prioritize and manage support tickets more effectively. Its AI, trained specifically on ecommerce topics, excels at automatically detecting customer sentiment and intent for each ticket, making it easy to triage and route support requests.

That said, it may not be the best choice for more established teams as their reporting and analytics are somewhat limited. While many common KPIs are included, it lacks the ability to filter and create custom metrics. Their customer support can sometimes be slow as well.

Pricing

Free trial available. Plans start at $10 per month, with costs based on your ticket volume.

3. Zendesk – Best for enterprise ecommerce businesses

If you’re in customer support, you’ve likely heard of Zendesk. Known for its extensive feature set, Zendesk offers everything from live chat and phone support to AI-powered chatbot workflows.

However, the sheer breadth of its capabilities can be both a blessing and a challenge. Their help center is overflowing with pages upon pages of documentation, but configuring advanced features often requires the assistance of a consultant or a dedicated Zendesk specialist on your team.

Key features

Comprehensive feature set: It’s an all-in-one solution for managing customer interactions, offering a shared inbox, analytics, a highly customizable knowledge base, and an array of triggers, rules, and AI automations.

Multi-brand support: Zendesk is one of the few help desk tools built to handle multi-brand customer support. If you’re running several distinct brands, you can manage support for all of them from within a single interface (although the feature is only available on the Enterprise Support plan).

Advanced customization: The platform offers advanced options to tailor workflows, automations, and integrations to your specific needs — this includes ticket views, language support, help center design, and more. This level of flexibility comes with a steep learning curve, though.

Who is Zendesk best suited for?

Zendesk is generally best suited for larger teams or enterprise-level ecommerce businesses. The complexity of the platform, the resources required for setup, and the overall cost make it a better fit for organizations with the budget and expertise to maximize its capabilities.

That said, they do offer a few lower-cost plans, though these lack features like chat, phone support, and custom reporting.

Pricing

Free trial available. Plans start at $19/agent per month.

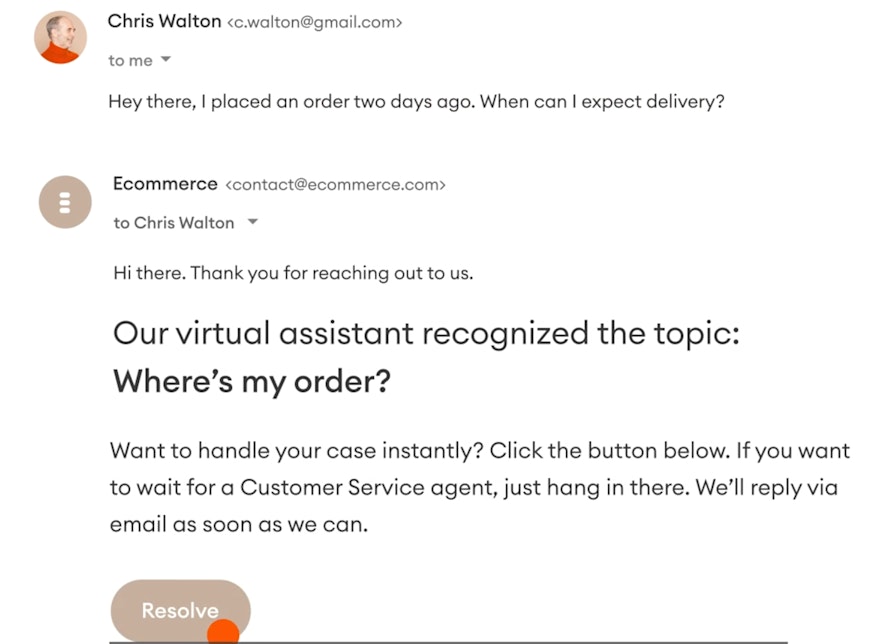

4. Supermoon – Best for deflecting customer support tickets with AI

Supermoon is an AI-first customer support platform designed to automate and streamline customer service processes by reducing support volume. Supermoon’s AI stands out for its effectiveness in providing proactive support. For example, it can suggest alternative products along with sharing return policies when customers ask about making a return.

Key features

AI-powered chatbot: Supermoon’s bot deflects tickets by leveraging information from your knowledge base, Shopify orders, and other connected sources. Unlike many other bots, it’s designed to anticipate the next question a customer might ask, providing proactive information to address it upfront.

Smart forms: For customers filling out support forms, Supermoon shows AI-generated answers in real-time as they type their questions. This automation can reportedly deflect up to 70% of incoming inquiries, reducing the need for human intervention.

Omnichannel inbox and AI-drafted responses: For social media and email tickets, Supermoon generates drafts based on previous interactions, aiming to close customer issues on the first resolution.

Who is Supermoon best suited for?

Supermoon is well suited for teams focused on efficiency and automation as well as for businesses with limited support resources. For instance, it can be an excellent fit for dropshipping operations, where dedicated support personnel may not always be available.

Pricing

Free trial available. Plans start at $15 per month, with costs based on the number of AI replies sent.

5. Zowie – Best for improving customer experience with AI

Zowie offers a robust suite of automation tools designed to enhance the customer experience. Exclusively tailored to ecommerce, Zowie’s specialized large language model makes it highly effective at managing the types of scenarios and requests common in the industry. Unlike tools that focus purely on automation, Zowie takes a customer-centric approach, ensuring AI is used to both solve problems and improve the overall experience.

In reviews on sites like G2, users call out Zowie’s lightning-fast performance. While quick loading times might seem like a small detail, they make a noticeable difference for support teams working through high ticket volumes. A second saved on every interaction can add up to significant time savings over the course of a week or month.

Key features

AI chatbot: Zowie’s bot uses conversational AI to handle up to 90% of customer inquiries. With a code-free setup and ecommerce integrations with tools like Shopify, it adapts to your brand’s voice and tone by learning from past chats, website content, and product catalogs.

Emailbot: For customers who prefer email support, Zowie’s emailbot recreates the speed and efficiency of chat support by recognizing the intent and inviting customers to follow a link to a live chat flow to resolve their issue quickly without waiting for an agent’s reply. While similar workflows can be configured in other help desk tools, it’s nice to have this solution out of the box.

Shared inbox: Zowie’s inbox helps support teams manage more complex issues that require human intervention with smart ticket routing, automatic duplicate recognition, and AI-generated ticket summaries. It also comes with draft polishing and one-click translation, allowing agents to respond quickly while maintaining high-quality communication.

Shopify integration: Agents are able to perform actions like refunds, cancellations, and order edits directly within Zowie, eliminating the need for switching between platforms.

Who is Zowie best suited for?

Zowie is great for established ecommerce brands that want to enhance efficiency and customer experience with AI. For larger support teams managing significant ticket volumes, Zowie can deliver substantial cost savings and productivity gains. However, for smaller businesses like dropshipping companies, the investment in Zowie might be too high.

Pricing

Pricing is tailored to each business’s specific needs and implementation. Free trial available upon request.

6. Sprout Social – Best for managing social media comments

Managing social media interactions gets tricky when your support team grows beyond a single person. How do you ensure no comments or messages slip through the cracks? And how do you avoid duplicate replies when multiple agents are handling the same accounts?

With Sprout Social, you can pull comments and messages from platforms like Instagram, Facebook, TikTok, and YouTube into a structured queue, complete with filters and sorting options. From that queue, your team will be able to:

Tag messages and comments to generate insights.

Use macros to respond faster to repetitive queries (instead of typing that “Could you share your order details so we can help?” message manually every time).

Collaborate using internal conversations on specific posts or comments.

Mark items as complete to track which interactions have been handled.

For some platforms, it also lets you ban problematic users directly from the tool.

Just a heads-up: Sprout Social logs you out if someone else logs into the same account. Shared logins won’t work, so be sure to purchase enough licenses for all agents who need access.

Pricing

Free trial available. Plans start at $199/seat per month.

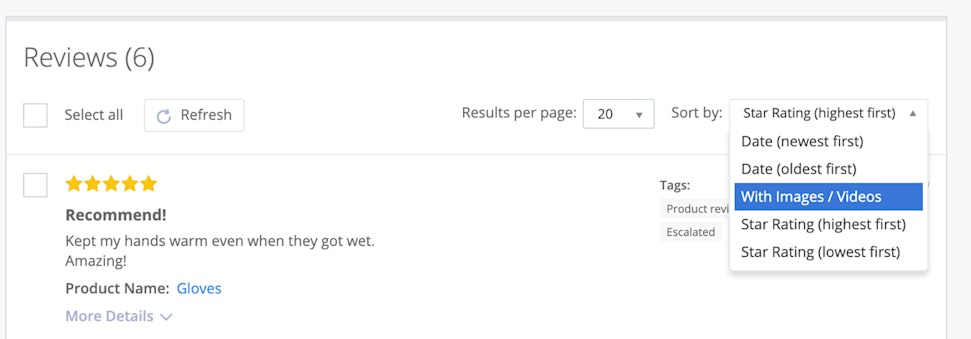

7. Yotpo – Best for managing ecommerce customer reviews

While generating customer reviews often falls under the marketing umbrella, it’s typically the support team handling them day to day. Yotpo’s suite of features designed to boost customer engagement and streamline review management makes this process really efficient.

With Yotpo, you can organize reviews and pull insights by tagging them.

Bulk actions are supported — whether that means publishing or rejecting multiple reviews at once. You can also set up rules to auto-publish reviews that don’t require human preview (for example, positive reviews without attachments).

Responding to reviews is also made simple. You can reply publicly, for example, to thank a customer for their kind words or send a private response if a review mentions an issue that requires you to share personal or order-specific information.

For reviews that require escalation, Yotpo lets you forward them directly to your escalation email address for further handling.

Once an issue has been resolved, you can re-request a review from the customer, giving them the opportunity to replace an outdated or inaccurate review with a new one.

Pricing

Plans start at $15 per month, with costs based on your monthly order volume.

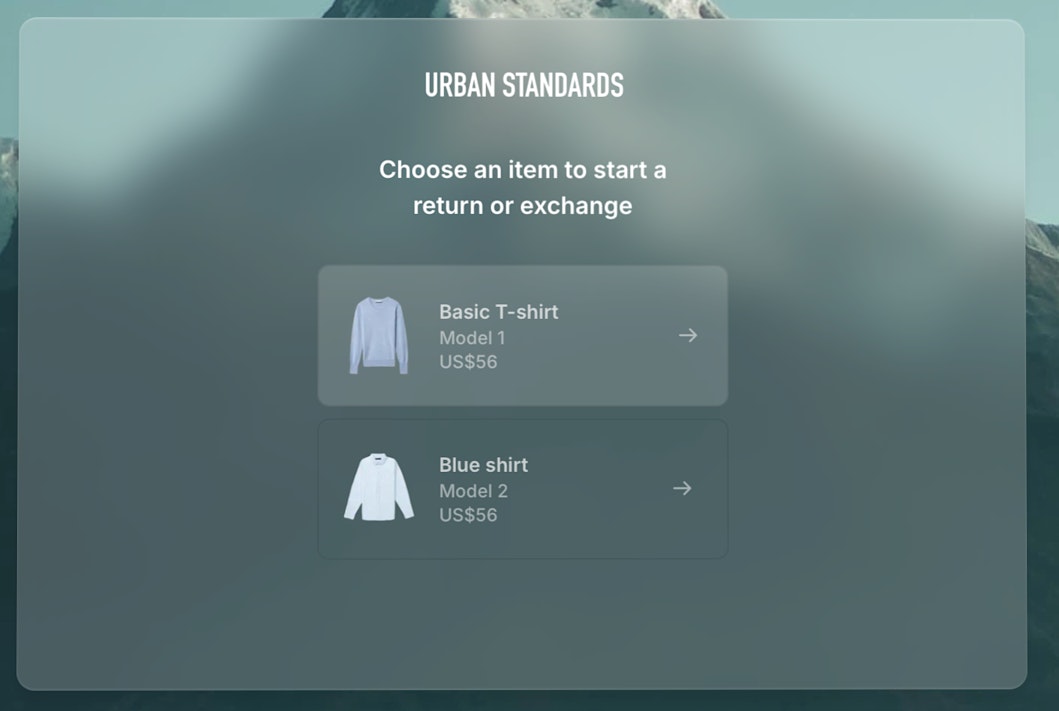

8. Loop Returns – Best for automating ecommerce returns

Not too long ago, manually processing returns and replacements was a massive drain on time for ecommerce support teams. Thankfully, that’s no longer the case for modern teams, thanks to tools like Loop. With Loop, you can empower customers to handle returns through a self-service returns portal, eliminating the need for direct support intervention.

The setup is simple:

Link your Loop portal in your return policy or order notifications.

Customers enter their order number, and the system performs checks to determine if they qualify for a return.

From there, the process is automated, as your team only needs to step in to approve returns once they’ve been marked as received.

The best thing is that you can configure Loop to encourage and incentivize customers to exchange products during the return process. As most ecommerce returns are due to wrong sizes or colors, it’s not surprising that Loop claims to convert 57% of returns into exchanges.

Pricing

Free plan available. Paid plans start at $155 per month.

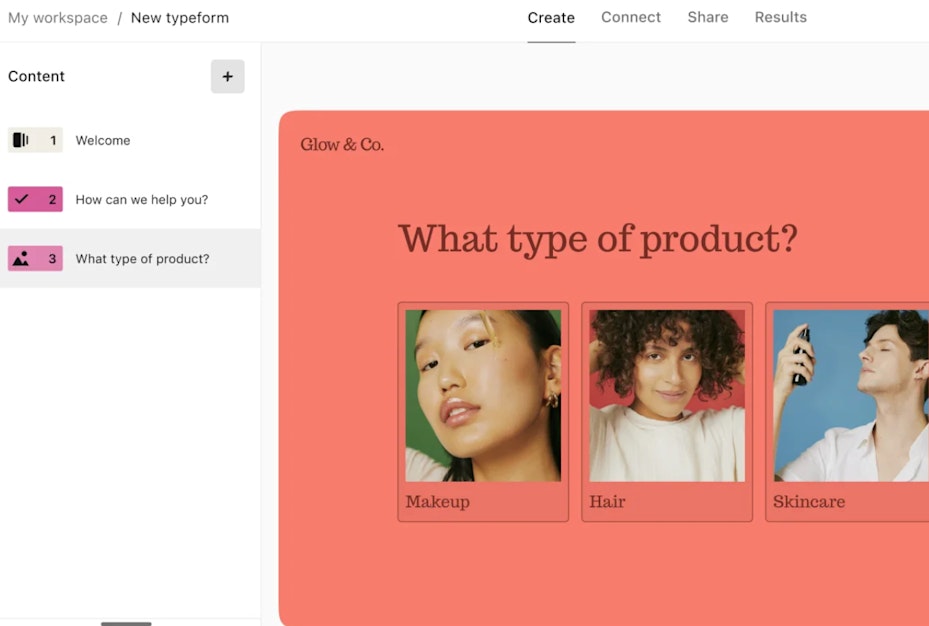

9. Typeform – Best for collecting feedback

Nearly every ecommerce support team I’ve worked with uses some kind of form tool — whether it’s for tracking customer satisfaction, collecting feedback, or running troubleshooting surveys.

Typeform stands out in this space with a powerful online form builder and survey tool that doesn’t require any technical skills to configure. They offer pre-built CSAT templates, and you can use the drag-and-drop builder with branching logic to create custom forms. One of my favorite features is the ability to embed surveys directly into emails, allowing customers to rate their experiences with a simple click on a rating scale, straight from their inbox.

One creative use I’ve seen for Typeform is a troubleshooting survey designed to ask customers the exact questions your team would typically ask during an issue diagnosis.

For example, if you sell electronic devices, the survey can walk the customer through the troubleshooting steps they’d normally follow with an agent. While live chat workflows might replace this for some teams, for email support, sending a form link can still be a helpful self-serve option.

Typeform integrates with Zapier, so by spending a few minutes on a Zap, you can even pull survey results into internal notes on the customer’s ticket in your help desk. This way, if the customer reaches back out, your team will already have their responses for quick reference.

Even with all its other features, if you’re only planning to use Typeform for feedback surveys, it’s still an excellent choice.

Pricing

Free plan and trial available. Paid plans start at $25 per month.

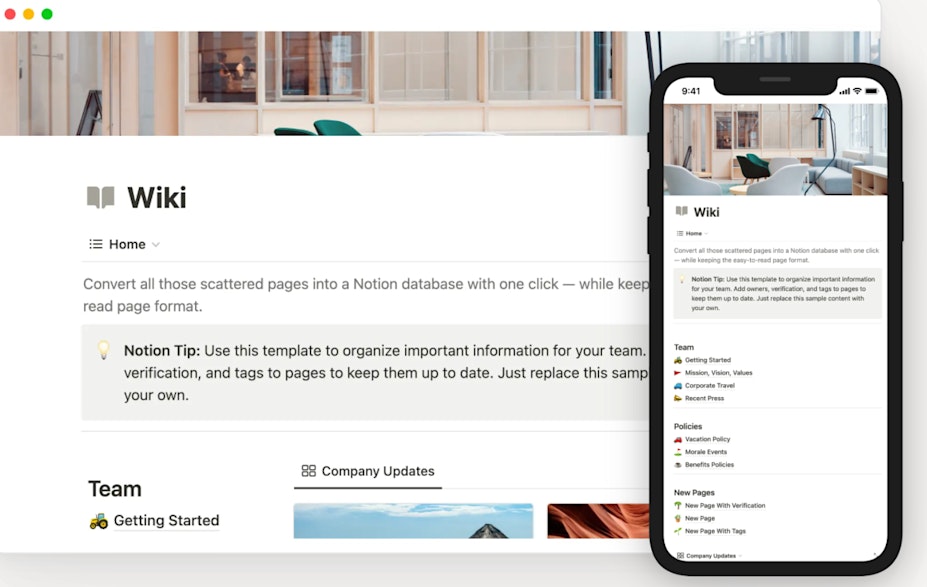

10. Notion – Best for internal knowledge base management

When it comes to managing product information, it should ideally live in your public knowledge base, but there’s also a lot of internal knowledge that needs to stay private. This could include things like which reviews your team should publish, what voice and tone to use in responses, how to approve returns, or where to look up restock dates.

Sure, you could store this in a Google Drive document, but as that document grows to 50+ pages, it quickly becomes unmanageable. I’ve tried a variety of solutions over the years — Google Docs, Guru, and even building a WordPress wiki site for my team. After all this, I believe Notion is the best tool for managing an ecommerce internal knowledge base.

With Notion, you can:

Create sections and subsections with granular control over permissions.

Access page views and edit history.

Drag and drop content blocks to easily organize information as your knowledge base expands.

One other thing I really appreciate about Notion is how well the search function works — much better than Guru’s search, for example. They also offer AI search, which can be useful for larger teams.

Pricing

Free plan available. Paid plans start at $10/seat per month.

Examples of companies delivering stellar ecommerce support

We all know Zappos set the gold standard for ecommerce service years ago, but plenty of other brands have also stepped up and built a name for themselves by delivering thoughtful, innovative customer experiences.

Here are three companies that are nailing it — and what you can learn from them.

Glossier: Omnichannel support with a personal touch

Glossier meets customers wherever they are — email, chat, DMs, you name it. Their customer experience team, known as the gTEAM, handles support across all channels and even jumps into social media comment sections to offer real-time help.

But they don’t stop at being highly responsive. Unlike many brands that view customer conversations as a cost to minimize, Glossier leans into them, seeing every interaction as a conversion opportunity.

Whether it’s answering questions in DMs or even hopping on FaceTime to chat about makeup, they meet customers where it makes the most sense and go the extra mile by sending personalized samples based on past purchases or specific skin concerns, turning every touchpoint into a mini brand moment.

Why it works: Glossier doesn’t just provide answers — they build relationships and meet customers where they are. By combining fast, omnichannel support with personalized recommendations, they create memorable experiences that keep customers coming back.

Zalando: Localized support for every market

Zalando, one of Europe’s leading fashion retailers, goes above and beyond by offering localized customer service across all of its target regions. From live support to help center content, Zalando ensures customers can get assistance in their native language, making it easy and accessible no matter where they’re shopping from.

Their product pages, FAQs, return policies, and order information are also fully localized and tailored to the languages and expectations of each market they serve. This level of personalization creates a seamless experience for customers across Europe, where language and shopping norms can vary widely.

Why it works: By localizing both their support and customer-facing content, Zalando is able to build trust, reduce confusion, and make international customers feel right at home.

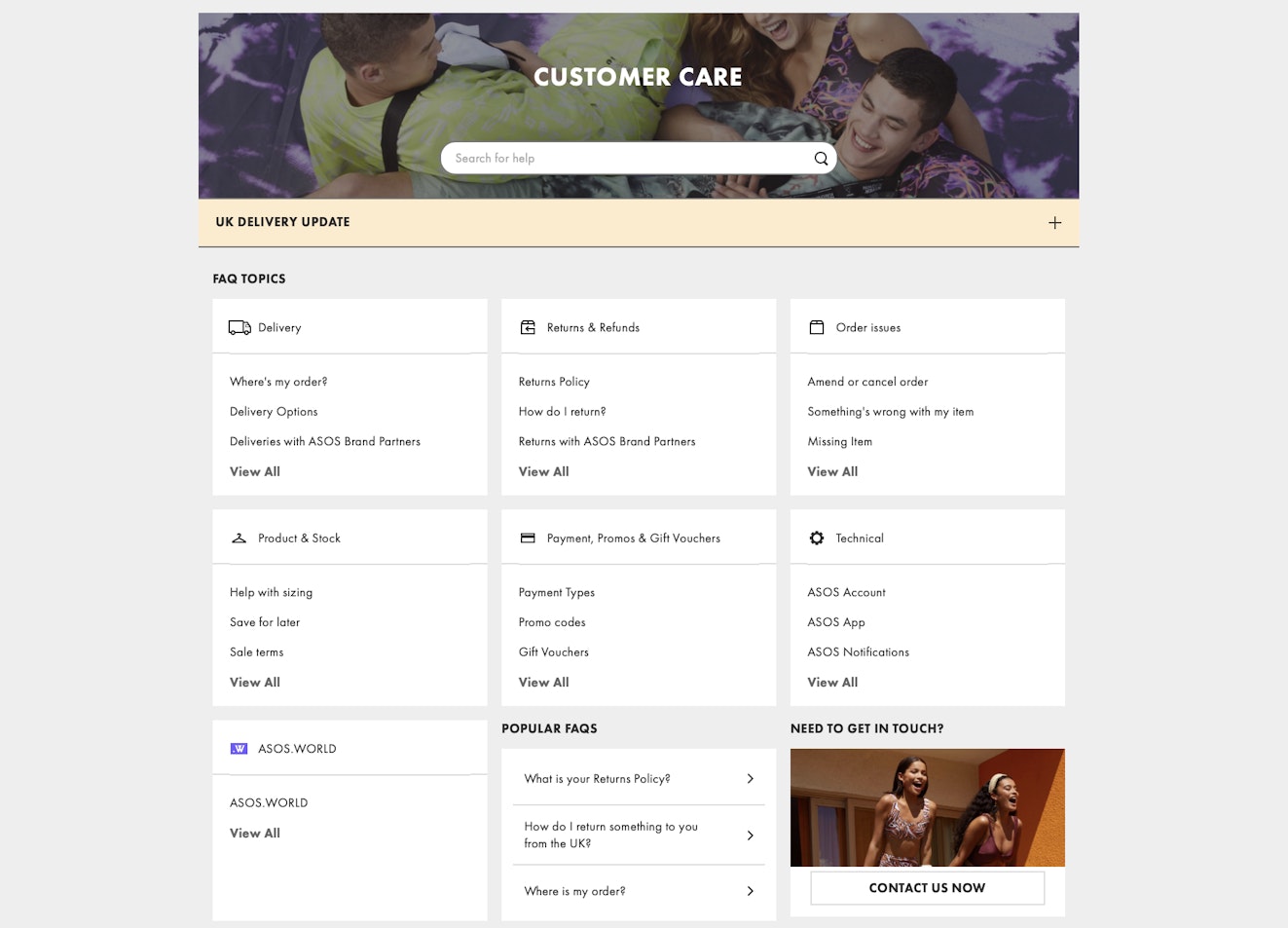

ASOS: Helpful self-service resources with a clear path to human help

ASOS makes it easy for customers to quickly get help on their own. Their support center is well-organized, with a prominent search bar, categorized FAQs, and common questions listed right at the top. It’s a near-perfect example of a helpful customer-facing knowledge base.

Beyond self-service resources, ASOS also clearly links to live support options, making sure customers can still get help if their issue is unique and isn’t addressed in the FAQs. They also keep service consistent across regions, tailoring experiences for global shoppers while keeping response times fast.

Why it works: ASOS strikes the right balance between efficiency, investing in self-service, and accessible human support. They respect the customer’s time while still showing up when it counts.

Improving your ecommerce customer service in 2025

As you continue to invest in marketing and grow your sales, don’t forget the power of keeping your customers happy, because the real magic happens when you turn one-time buyers into loyal brand advocates.

By putting the strategies and best practices in this guide into action, you can support your customers effectively while boosting customer lifetime value and turning support into a true growth engine.